When a new governor or president takes office, newspaper columns and the blogosphere are full of unsolicited advice for how the new person in charge, and that person’s team, can make things better. Perhaps the appointment of Greg Gaskins as the new Deputy Treasurer and Secretary to the Local Government Commission doesn’t have quite the same cache as installing a president or governor, but with the change at the LGC, naturally we thought we’d offer a few bits of completely unsolicited advice for how the LGC and its staff could make life better for the Commission’s constituents (and North Carolina public finance in general) without new legislation and (at least as it seems to us) without undue burden on staff or resources.

Improve website accessibility

When we asked some Friends of the Firm for help on this post, their ideas focused on fixing the website. Let us emphasize these are suggestions designed to help the local governments that are the LGC’s constituents. Let’s make it easier on the part-time clerk/finance officer who borrows money once every five years, or anyone who ever misfiled an email. Specifically:

Clearly post information (names, phone numbers and emails) as to who to call with what kinds of questions.

We all like to know who to call with questions about a particular item and how to reach that person. Many state government websites have those sorts of directories and we’d like to see that at the LGC. Three great examples of finding whom you should talk to for an area are found at the NC Department of Commerce and the NC Department of Revenue.

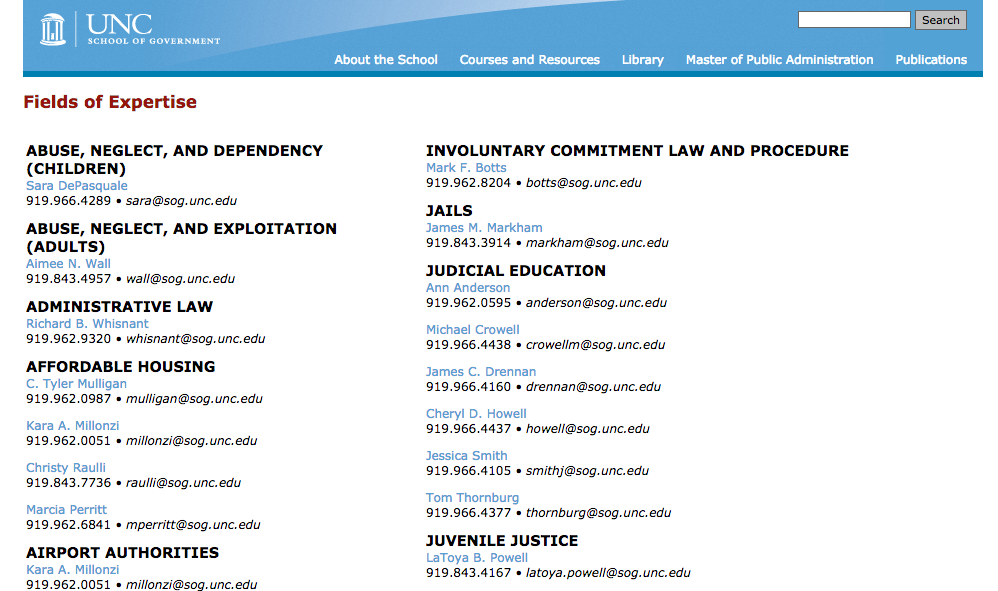

Here’s a screenshot of how the UNC School of Government provides this information; something like this is ideally what we’d like to see from the LGC:

This quick fix would make it easier for everyone to know to call Gordon Johnson with a general question about general obligation bonds, to contact Dianne Kelly if they have a USDA revenue bond project, or to get in touch with Joe Futima about an installment financing. Today, if folks don’t know whom to call, they have to call the general number (once they find it), and then perhaps trade calls in search of an email address. For those of us who do this work every day perhaps it’s no big deal, but if you are a new local government officer (to the area or generally) or an infrequent borrower, this can be daunting.

Put the Application Forms on the Website as Fillable PDFs.

We know that staff has expressed reluctance to post the blank application forms for various reasons, but it is consistently identified to us as a source of annoyance. The on-line version of the applications could still include a prominent (big, bold, underlined) statement about being sure to consult with LGC staff in connection with completing and filing an application. If nothing else, using fillable pdfs would make it easier to complete the applications, and certainly easier for staff to read them once they get there.

Post Information About Current Rates.

We understand that LGC staff doesn’t want to be held responsible for quoting a rate that the unit later can’t obtain. But if someone calls with a question, staff will in fact provide an estimate. So what’s the difference? We are not asking for the site to feature blue-sky estimates. Perhaps it could have a chart of “rates on recently completed financings,” that does not include names of borrowers or lenders. But why not something like a table of recent rates that says “yesterday’s sale of 20-year GO bonds for an AA-rated county, average maturity 10.25 years, NIC 4.27.” Or, a table of installment financing rates from the most recent LGC meeting?

Two More Non-Website Ideas

Fix the glitch with revenue bond application fees.

The current LGC regulations impose a charge of $12,500 for each revenue bond approval. It would be more appropriate for those application fees to mirror those that apply for installment financings—so make it $1,250 for a bank-placement financing and $12,500 for public offerings. It’s always easy to say that someone else would face only a minor decrease in fee revenues—but the current schedule creates an artificial disincentive to use revenue bonds, and seems to have been an unintended result of the last round of fee adjustments.

Expand the use of alternative forms of “competitive” sales for general obligation bonds.

The statutes currently provide that general obligation bonds (with the exception of refunding bonds and some sales for lower-rated units) have to be sold through a “competitive” basis. In practice, the LGC has required these sales to be sold with a fully-developed official statement and ratings from the national bond rating services. But the statute only says “competitive,” and that can mean something different. The need to incur the related high issuance costs drives borrowers to forego small G.O. bond sales and instead pursue installment financings. An entity with $2 million in two-thirds bonds capacity and some land to buy is driven into a bank-loan 160A-20 because of the prohibitive financing costs; is that really what the LGC wants the outcome to be? The LGC runs a process for the sale of bond anticipation notes that is “competitive” without requiring the use of a fully-developed official statement or the cost of bond ratings. It would seem relatively simple for the Commission to adopt a policy or regulations to use a similar process for general obligation bonds with a face amount of $10 million or less (there may be a better number to choose, $10 million is our suggestion).

Our idea in this post has been to focus on simple ideas that don’t implicate broad policy questions or matters of existing controversy—so we won’t bring up our views on the LGC’s policies toward USDA refundings (amply discussed here and here . . . OK, we just did, but that’ll be the end of it). If you like any of these ideas, or have your own, we encourage you to pass along your thoughts to the new Secretary or other LGC staff members. Listening to your concerns (if not necessarily agreeing) is at least part of what they are there for.