BLOG

BLOG

It’s Time to Think About Using your Capacity to Issue “Two-Thirds Bonds.”

We think of “two-thirds bonds” as the “unsung heroes” of North Carolina public finance. Two-thirds bonds are a type of general obligation bond that doesn’t require voter approval. They are an underutilized funding resource.

“Synthetic TIF” as an Economic Development Financing Tool

We occasionally field questions about the use of “Synthetic TIF” to finance economic development projects so we thought we’d pen a quick post to explain how a local government can use a “Synthetic TIF” for economic development.

February is a Good Time to Start Working Toward a November Bond Referendum

Folks who haven’t been through a bond referendum before—and for that matter, those that have—often underestimate how long the formal process takes. Generally, you need to start the formal process by June to have a comfortable schedule working toward a November...

Infrastructure P3 Best Practices

Here’s a great article on what makes for a great infrastructure public-private partnership (P3) from the Brookings Institution. I commend it to you and this blog post is primarily a few takeaways from the article.

January is a Good Month to Look for Refinancing Opportunities

Interest rates tend to be lower at the beginning of the calendar year, and business is customarily slow for lenders at the start of the year as well. Those two trends make January a great time to review your outstanding debt and ask your friendly neighborhood bankers...

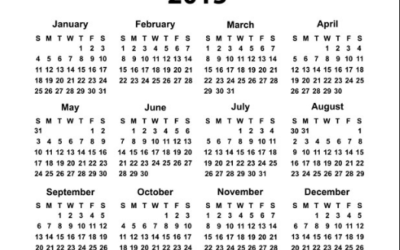

2015 LGC Calendar

We now have the official calendar for meetings of the Local Government Commission for 2015. We thought a table might be handy.

Along with the meeting dates, this table shows the dates 28 days prior to the meeting, because generally the Commission staff wants a fairly complete application package in hand by then. We’ve also noted the dates 45 days prior to the meeting dates, because that’s the deadline for sending in your advance notice to the General Assembly’s Joint Committee on Local Government (see this post for more information on that requirement).

Waterstone + 1 Year

We are taking a different approach today at the blog and checking in with the Town of Hillsborough, still the only local government to date who has used Special Assessment Revenue Bonds as part of the new authority authorized in 2008 (and set to expire in 2015). Often, when someone is a “first adopter,” they end up having to create new processes to implement a program, rather than working from a path someone else has laid. This blog post will highlight the Town of Hillsborough’s work with the Waterstone Development District to see how things are going a year after the bonds were issued. We also engaged in some amateur photograph and videography of the development that we hope you enjoy as well.

Best Practices for Waivers of Attorney Conflicts by Local Governments

Lawyers often ask their local government clients to waive conflicts of interest. Here are some suggested rules for how a local government should handle conflict waiver requests from its outside lawyers:

The Attorney’s Preliminary Opinion to the LGC on an Installment Financing—A Better Form

When a North Carolina local government unit applies to the Local Government Commission (the “LGC”) for its approval of an installment financing, the unit has to supply an opinion of the unit’s attorney as part of the application package. The LGC's Form The LGC’s...

New Law Restricts Bond Elections to Regular Election Dates

Recent changes to North Carolina election laws restrict a local government’s ability to hold referenda on general obligation (“G.O.”) bonds. The main takeaway is this: G.O. bond elections now can be held only on dates when all the voting precincts in the jurisdiction are otherwise required to be open. This essentially restricts counties to holding bond elections only in even-numbered years on the primary or general election dates, while municipalities can choose those dates or their own primary and general election dates in odd-numbered years. There are, of course, some limited exceptions.